Details

Written by: RJ

Requirements

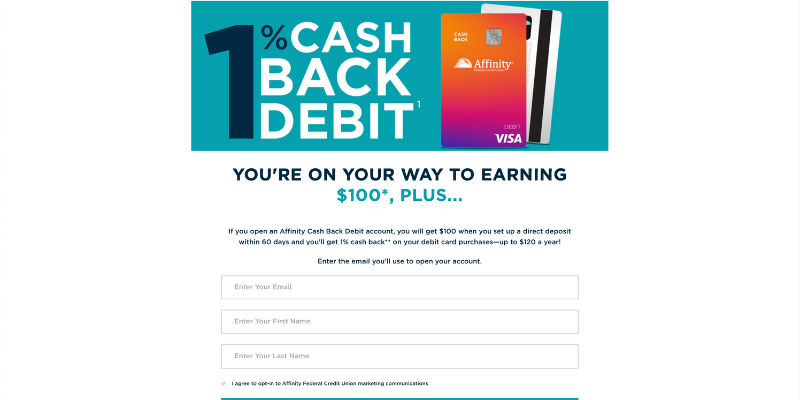

- Open a new Affinity Cash Back Debit Account

- Direct deposit $500 within 60 days of account opening

Eligibility

- Nationwide

- Pick one of their 2,000 organizations

- Donate $5 to NJ Coalition for Financial Education

- New customers only

Fees

- No account fees

Account Closure

- Keep account open 6 months

No end date listed

Notes

- In the past there’s been up to $1k in credit card funding allowed.

Thoughts

Another easy credit union bonus. The better part is the referral program. You can earn $1k a year from it. Also, you can check out the Affinity Cash Back card while you’re here. It’s basically the Chase Amazon card but without the 5/24 rule.

Was up for churning abd had a credit card I was going to send some fruning through. Just called the customer service and they told me need to be in the New York/New Jersey tri-state area to be approved for membership.

We’re sorry to inform you that we are unable to authenticate you at

this time. This decision is based on the information provided in your

application.

Denied because I don’t live in the Jersey area? haha, they must still operate in the 1800’s

I was denied as well, could not authenticate me. Is this common?

RJ, do you know of any 1% flat rate cashback debit cards besides Affinity and Discover’s?

BTW, if you use the Affinity debit card to load cashapp it triggers the 1% back.

I think upgrade still offers 1x back on their debit card but not sure about the Cash app part. Most have caught onto that game.

Are they Chex friendly and do I need a social security card? I have a license and passport. Thank you

Not super sensitive but they will deny over Chex. I don’t remember if they ask for a SSN copy. Most don’t.

Denied, could not authenticate me.

Ooh, I am interested in this credit union not only due to the Affinity credit card but also the $1k cc funding. Perhaps $1k cc funding per account? checking, savings, cd, money market? 🙂

Watched a video by Joshua Butler on this Affinity credit card they offer. It looks really nice, 5% cashback without having an Amazon Prime membership — great b/c I generally don’t ever have one except for months where they give it to me for free or for the $1.99/week special offer.

Also starting Q1 of 2023 the Affinity card gives you an extra 1.5% cashback if you spend $2000 in Q1.. effectively making it a 6.5% amazon card as well as a 2.5% catchall , for exactly $2000 –or slightly over– spent in that quarter.

I was asked for a scan of my physical Social Security Card. So, I would suggest having that on hand before attempting this offer.

Link expired maybe? Only the banner shows, no fields to fill out

It works for me in Safari. Took a min to load the fields but there’s a name and email field.

Hello,

Would pushing from US Bank count as a direct deposit for the $100 referral bonus?

I don’t have direct deposit :/

Best way to fake it is to use a business account. Add Affinity as a vendor like you’re paying a bill. USB may work but I don’t know for sure. Could also try sending the funds from a few different places to increase the odds.

RJ, I am asking for “Where can I find my referral link”

PS: of course , I have used yours to open the account.

oh gotcha. When you log in there’s a box on the right hand side that says refer a friend program

RJ,

Thank you for this find.

Where can I find my referral link?

Good hunting sir – https://share.affinityfcu.org/Ryan42+42292ffb05!a

I applied using your link and Affinity FCU wants the full name of the person who referred me or they won’t proceed with the application. They also want to know my plans for the account but won’t get to that unless I tell them the full name of who referred me. I plan to keep and use the account which isn’t a problem but I don’t know your full name.

Ryan Johnson

I’d go with it’s a checking account for every day expenses. Affinity had good reviews so you decided to give them a try.

I called to find out how things work with their debit cards and overdrafts and so forth. I wanted to set it so no overdraft could happen at all on the account which is how I set all accounts if possible. Getting 1% back on up to $1000 a month in debit card purchases seems interesting for a debit card at least. I was told that even if one has overdrafts disabled, a declined transaction on a debit card results in a $33 charge no matter what. I don’t know if other banks are typically like that but I don’t like that at all.