Details

Written by: RJ

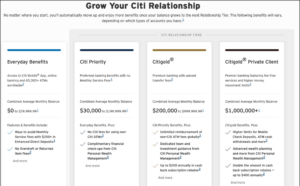

Citi has refreshed its banking tiers. Previously the deposit account products were separated into ‘account packages’ where a user would pick the package to best fit their needs (or easiest to hit a bonus with)

Now Citi will have the Citi Relationship program. Your relationship tier is based on your combined average monthly balance between deposit and investment accounts. If the combined balance drops below the tier requirement for three straight months, you’ll be bumped down to the next tier.

Thoughts

It’s technically simplified, though I’d assume most people were selecting the lowest Citi checking package by default. This is designed to make it look more appealing to grow your Citi relationship. However, when it comes to relationship banking BofA still has the better program. Simply because they offer incentives across products to have a ‘deeper’ relationship. I don’t see any additional benefit to most people with this Citi change.