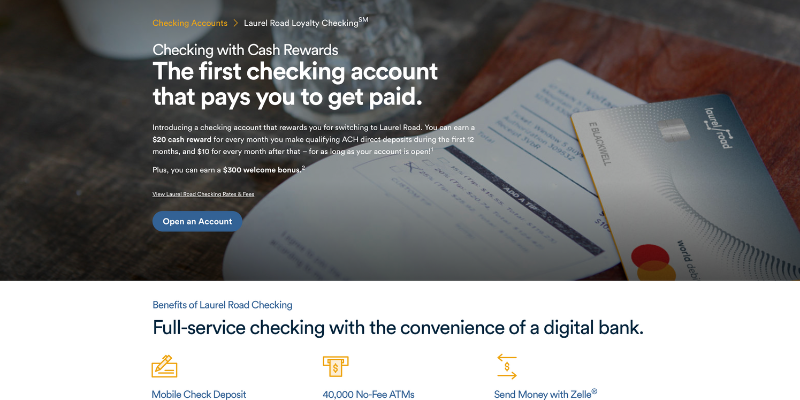

Offer Details

Written by: RJ

Requirements

- Open a Laurel Road Loyalty Checking account

- Direct deposit $2,500 within 60 days of account opening – $300

- Direct deposit $2,500/month (month 2 – 13) – $20/month

- Becomes $10/month after this

Eligibility

- Nationwide

- Can’t have had a checking account within the last 24 months

Fees

- Checking is fee free

Account Closure

- Keep account open 180 days

Valid through 10/15/24

Thoughts

If you do both the $240 and the $20/month for the full 13 months, this nets out to $540. I’m currently doing this by setting up a reoccurring automated ACH of $2,500/month from Ally to Laurel Road. Transfer happens on the 1st of each month. I then send the same $2,500 back from Laurel to Ally. I’ll likely close it after month 13 posts. Rather get back in line to churn it vs collecting $10/month.

I got an email saying they are changing the requirements for direct deposit, so the $2500 ACH transfer won’t work anymore. Change takes effect April 1, 2024

Is you Ally Act from a business account or personal?

Personal Ally account. I don’t think they do business products.

Do they use Chex?

I don’t believe they are sensitive

They denied me for my chex report

I recently did this by turning money from my Novo account to Laurel. This was the easiest thing ever. I got paid out in about 7 days.

Business accounts are a good secret weapon for DD’s. If you send the transfer from the business account like you’re paying an invoice vs a regular ACH, it can trigger.

How do you set it up to look like an invoice? For business accounts I have Chase and Navy Federal. Thank you, Gene

You send it from the bill pay service in the account opposed to the ACH option. It’s the same thing except biz accounts can send money to accounts you don’t own (how an employer pays you) as where ACH is only allowed to/from accounts you own