Offer Details

Written by: RJ

Requirements

- Open a new Santander Select checking account

- $25 opening deposit

- Direct deposit $5k within 90 days of opening

- Bonus posts within 30 days of completion

Eligibility

- CT, DE, FL, MA, NH, NJ, NY, PA, RI

- Can’t have had a checking account in the past 12 months

Fees

- Simply Right checking – $10 monthly fee is waived with one transaction – a deposit, withdrawal, transfer, or payment – posted during the calendar month

Account Closure

- No rule listed

Chex

- Yes

Valid through: 12/31/24

Thoughts

I believe this offer has gone as high as $500 in the past. The $25 account fee hurts but usually account fees get waived in the first 1-3 months of opening. Since you have to go in branch, ask the banker.

HI—-You said Account Closure

Keep account open 90 days

Here is the offer. I didn’t see anything about 90 days ? If that’s the case, seems like after receiving the bonus you can close it down

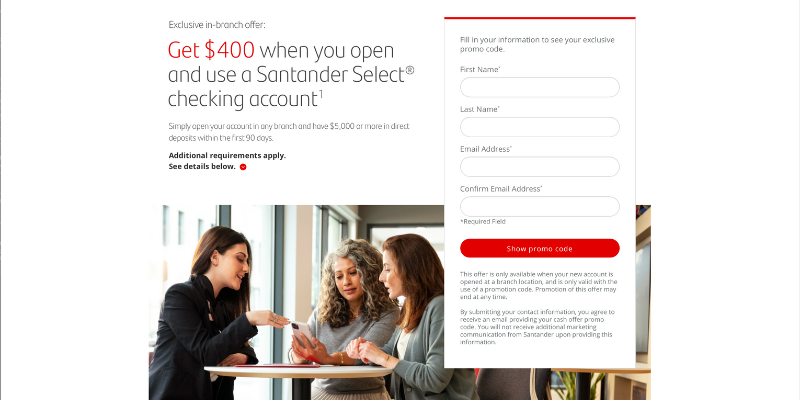

Get $400 when you open a new Santander Select® Checking, Simply Right® Checking, or Santander® Private Client Checking account ($25 minimum opening deposit on all) by 10/03/2023 and have direct deposits totaling $5,000 or more post to this account within the first 90 days. Account must be opened in a branch. The 90 day period begins the day of account opening, unless the account is opened on a weekend or holiday, in which case the period begins on the first business day after account opening. Offer is transferable until redeemed by the addressee and we reserve the right, in our sole discretion, to limit the number of times this Promotion Code may be used. You must be 18 years or older. Offer is not available if any account owner is a current checking customer of Santander or had a Santander checking account in the last 12 months prior to account opening. Offer cannot be combined with any other bonus offer. Promotion Code must be entered at new account opening to be eligible for this offer, and cannot later be added to an account, or changed, unless it is presented and applied within 14 days of account opening. The account must remain open in an eligible account type until payment of bonus, which will occur within 30 days thereafter. In addition, the account must remain open and in good standing to be bonus eligible. Bonus is considered interest and will be reported to the IRS on Form 1099-INT. If multiple accounts are opened with the same signer, only one account will be eligible for the bonus. For new checking account customers only. Offer is only available to residents of NH, MA, RI, CT, DE, NY, NJ, PA, or FL (Florida Eligibility: This offer is only eligible online in ZIP codes within Miami Dade, Monroe, and Broward Counties, including ZIP code 34141). As of 01/19/2023, the Annual Percentage Yield (APY) for Santander Select® Checking is 0.01%, and 0.03% for Santander® Private Client Checking. Rates may change at any time and after the account is opened. Fees may reduce earnings. Offer expires 10/03/2023. This offer is subject to change at any time. Offer is only valid with use of a Promotion Code. Promotion of this offer may end at any time.

The other thing you want to check is the fee schedule. Often times it’s listed there as a general account rule. This time, I stand corrected. It’s no longer listed https://www.santanderbank.com/documents/330001/0/Personal-Deposit-Account-Fee-Schedule.pdf

Unless it is stated for longer, I would leep every account opened for binus chasing for 90 days so you do not end up on a blacklist in case you wanted to churn it in the future.

hi——any idea if a wells fargo savings account would be accepted as a direct deposit ? this list says wells fargo checkings would be accepted

https://www.doctorofcredit.com/knowledge-base/list-methods-banks-count-direct-deposits/

I can’t say. It’s likely it would work. I don’t usually see checking/savings info in the transaction line. Coming from the same place so I say give it a shot